An integrated approach to wealth management

Partnering for Financial Success: How a Wealth Management Firm Benefits Credit Unions & Their Members

At Sheid Wealth Management, we believe in the power of partnership. By collaborating with Evolve Credit Union, we provide their members with tailored financial planning and investment strategies, enhancing member services while creating a new revenue stream for the credit union.

Key Benefits of Partnership:

✅ Comprehensive Financial Services – Credit union members gain access to professional wealth management, including retirement planning, investment strategies, and estate planning, ensuring their financial needs are met under one roof.

✅ Increased Member Retention & Satisfaction – Offering wealth management services strengthens member relationships, deepening trust, and loyalty to the credit union.

✅ New Revenue Stream – Through a strategic partnership, credit unions can earn revenue via referral fees or revenue-sharing models, turning an added service into a financial benefit.

✅ Regulatory & Fiduciary Expertise – Our firm handles compliance, risk management, and fiduciary responsibilities, ensuring services are delivered with the highest level of professionalism and oversight.

✅ Community-Focused Approach – As a local wealth management firm, we align with the credit union’s mission of serving the community, ensuring members receive personalized, values-driven financial guidance.

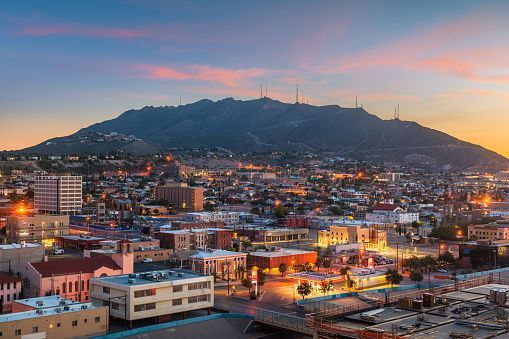

Slide title

Write your caption hereButton

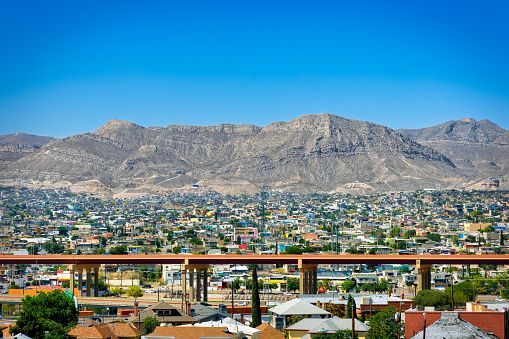

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton